Whether you're purchasing a new home, refinancing, or using the equity in your home to make improvements. We will help you find the best loan for your needs. Transform your home using the equity you’ve already earned to cover renovations. Do the math to get an estimate of how much your home equity line of credit could be. Stay connected to your accounts wherever you go, whenever you need. We have partnered with Insurance Services to track and verify insurance coverage.

The loan amount, the interest rate and the term of the mortgage impact a mortgage payment. In addition, there are typically monthly allocations for property taxes, hazard insurance and private mortgage insurance . Use our mortgage calculator to see how each of these variables could affect your potential mortgage payment. Buying your first home is one of the biggest investments you’ll make, which is why our knowledgeable mortgage lenders are here to walk you through each step in the homebuying process. Plus, our First-Time Homebuyer Loan2 features an adjustable rate with down payment options as low as $500.It’s flexible and friendly, with a 100% Loan to Value 3.

Private Banking

California Credit Union assumes no liability for any outside website's content, information, products, services, privacy policies, security, or external links. California Credit Union does not represent either the third-party or the member if the two enter into a transaction. Privacy and security policies may differ from those practiced by the credit union. We are a leader in the credit union mortgage industry because we invest in our people, products, services, and most importantly, our credit union partners. We use that leadership and expertise to help optimize workflows, measure and monitor risk and instill best practices. It may make sense to consolidate some of your credit card and other debt into a new loan — such as a home equity or personal loan.

We offer competitive rates on a wide variety of options – including fixed-rate and adjustable-rate mortgages, as well as VA Loans. Determine your monthly auto loan payment or purchase price with the Car Loan Payment Calculator from Sheridan Community Federal Credit Union. The United States Department of Agriculture offers a special loan for home purchases in rural areas. With a USDA loan you can qualify for lower monthly payments and no down payment. If a borrower doesn’t have enough cash on hand to buy a home outright, they will most likely need to get financing.

Auto Loan

If you don’t have the cash for a large down payment, this is an excellent option because the minimum down payment percentage is lower than a conventional mortgage. We highly recommend this loan for first-time homebuyers. Our variety of credit card options offer you low rates and high rewards.

Use this calculator to help you determine a possible range of credit scores based on your financial situation. When it comes to paying back your loan, there are enough things to be stressed about, and we don’t think your payment method should be one of them. Find their routing number, loan rates and historical data here. … Federally Insured Home Equity Conversion Mortgage , 0, 0, 0, 0. CACU began 2020 as a $3 billion corporate credit union, … equivalents are placed with the Federal Reserve and the Federal Home Loan Bank . To see our most current home equity rates, check out the top of this page or our Rates page.

Business Auto Loan

Our experienced mortgage loan experts love to save people money, so let’s see if refinancing your mortgage could help you save money. Our online mortgage refinance calculator is a great place to start. And don’t forget, having your mortgage with us may help you increase your share of our Profit Payout. Whatever your reason for refinancing, we can help you find the option that’s best for you. Use Bank of America’s auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. Annual Percentage Rate (“APR”) is for well-qualified borrowers.

Try out some of our handy online mortgage calculators to help you set your homebuying budget and estimate your monthly mortgage payments. When you’re ready to get started, we’re ready to help. Estimate your monthly payments and how much you may be able to borrow, using the auto loan calculator below. Use this auto refinance calculator to compare your current auto loan with a refinanced auto loan to see if you could lower your monthly payment. A home loan lets you borrow the funds needed to purchase your home. Your monthly mortgage payment includes the cost of the house, interest, private mortgage insurance if applicable and other relevant fees.

How much equity do I need to refinance?

As a general rule, you should owe less than 95% of your home’s value before considering a refinance. Use our calculatorto see if refinancing could be a good option for you. I’ve been with them for 21 years and I’m happy to say that I hope it’ll be another 21!!! I can truly say that this bank has great customer service. There are several important steps to improve application security in your development process.

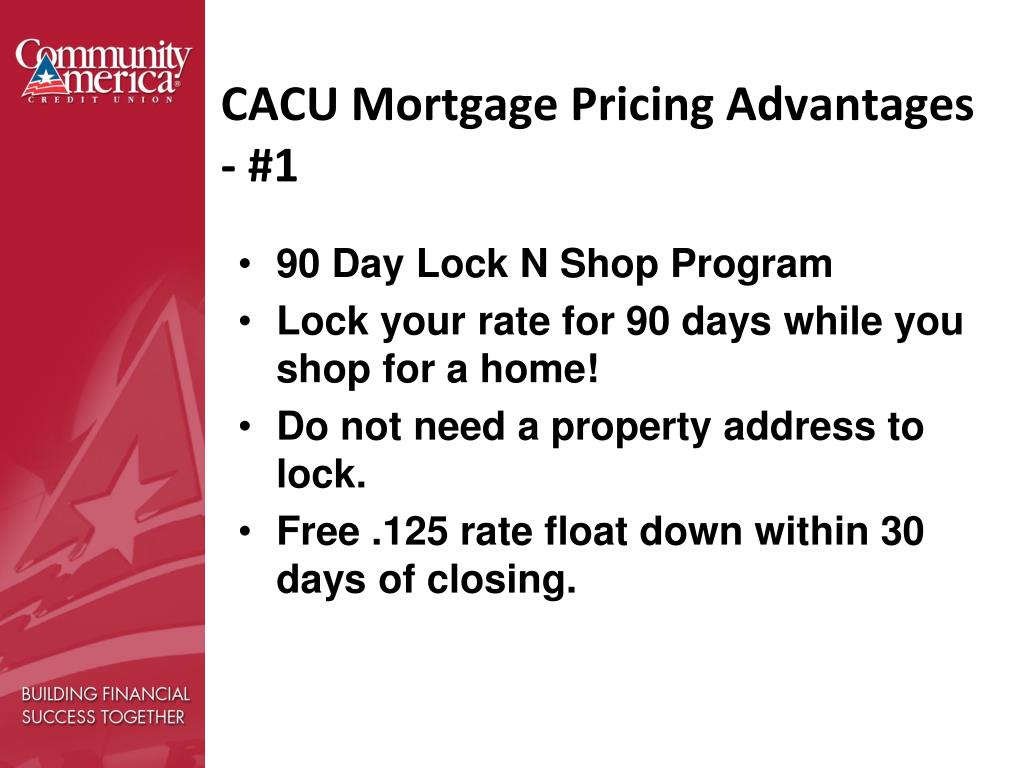

As your life changes, your mortgage needs might as well. You can refinance your mortgage with us and save on your monthly payment while taking advantage of low interest rates. A Home Equity Loan is a lump sum of money with a fixed rate, while a Home Equity Line of Credit is a revolving line of credit with a variable rate that you can draw from at any time. CommunityAmerica offers a Hybrid Home Equity, which is the best of both worlds. You are able to get the flexibility to draw from a line of credit when the need arises and the added benefit of locking in a fixed rate on your balance.

Here are some frequently asked questions we receive about getting an auto loan. Starting September 1st, 2022, we have changed the mailing address for members to send their mortgage payments. Through our turnkey mortgage lending solutions and best-in-class servicing, our credit union partners have direct access to mortgage experts with decades of experience. Turn time into money with a fixed rate Certificate of Deposit . We have many Mortgage Loan Programs with competitive fixed and adjustable rates to fit most any situation. It’s our job and our pleasure to make your mortgage experience the best it can be.

Imagine what it will feel like when more of your members start to obtain their mortgages through your credit union. Most members' mortgages aren't with their credit union. When you take the current value of your home, minus the amount you owe, that’s a good estimate of how much equity you have invested. The equity you’ve built can potentially be used in a variety of ways, such as debt consolidation, home improvement projects, weddings, medical bills, vacations, and emergency funds. Use our calculatorto get an idea of how much equity you might have to work with.

With a Home Equity Line-of-Credit you can access cash whenever you need it. Your house is an asset that can help you reach your financial goals. Our clients have experienced this too, and they have found comfort in our trusted approach, expert team, and proven results for their members’ mortgage needs. One that’s transparent and straightforward, with privately labeled originations and servicing, regardless if the loan is sold or held in a portfolio. Bring your members a seamless mortgage experience with state-of-the-art technology. Let TruHome help you deliver the mortgage experience your members deserve.

Adoptions, weddings, emergency funds — that’s why we call it the “anything” loan. Through our wholly-owned service organization, California Members Title Company provides local, personalized, low-cost services for all your title and escrow needs. Using an updated version will help protect your accounts and provide a better experience. Just paid my loan online and it couldn't have been any easier.

Loans & Credit Cards

If you have received a letter from Insurance Services asking for verification of insurance, you may update your insurance information online. Use our calculators to make the most informed mortgage decisions. Determine how much of a mortgage you may be able to obtain.

No comments:

Post a Comment